The Search Engine Market in Japan

Introduction

Search engines play a key role in any online digital marketing strategy, which is a big part of go-to-market. This definitely applies to Japan, but there are similarities and differences compared to global search engines. Similar to the global markets, Google is the dominant player. Unlike the global market, Yahoo has a strong presence in Japan. There’s also a preference to search on mobile compared to the global markets. Search engines in Japan, though similar to global markets, have nuances unique to the local market.

Top Search Engines in Japan

Google is the dominant player in Japan with 78.17% of the search engine market share. They are the market leader in Japan, but their presence is not as large compared to the US sitting at 87.11%.

Bing

Bing comes in second overcoming Yahoo’s number 2 position. Bing’s user base has increased from 8.1% to 10.72% in the past year. Though they are in second place, Bing is not as commonly discussed as Google or Yahoo.

Yahoo

Yahoo has a strong presence in Japan due to its early entry into Japan at the rise of the internet. The comany had entered Japan and heavily tailored its platform to the Japanese market. Though they were the dominant player in the early days of the internet, their current market share is 9.76%, declining from 13.91% in May 2023.

Yahoo’s Presence in Japan

Yahoo’s Presence in Japan

Yahoo has such a large presence in Japan because it launched as the first Japanese language search engine in Japan in 1996, five years before Google. Softbank, a local telecommunications powerhouse, was a stakeholder in Yahoo’s Japan entity and helped it build a strong local presence. Yahoo hyper-optimized for the Japanese market and became the dominant search engine in Japan (can’t stress the importance of localization enough). Yahoo Japan provided services that are unique to Japan, including Yahoo Auction. The Japanese entity, completely separate from the US entity, became so successful and dominant that it was almost as valuable as the US entity, with both being valued at over $20b USD. Yahoo Japan had a five-year head start and became the standard for the early internet adopters.

Desktop vs. Mobile

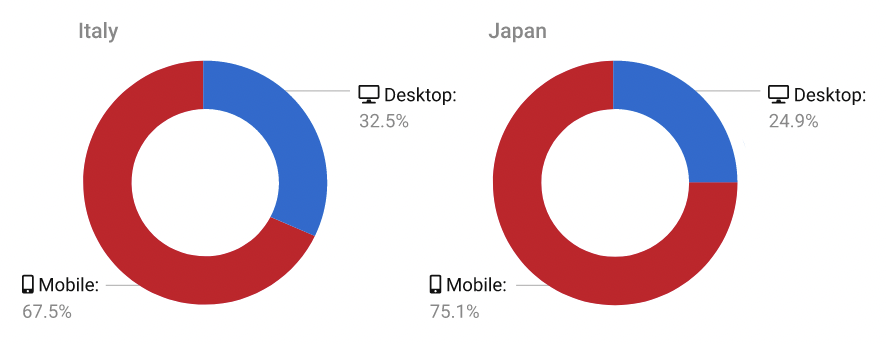

There’s also some uniqueness in the device that people use to search in Japan. Globally, the average search on mobile is 64.1%, and on desktop is 35.9%. In Japan, the search is skewed even further to mobile at 75.1% while 24.9% of searches happen on desktops.

Search Engine Marketing (SEM)

Search Engine Marketing (SEM)

Search engine marketing is an effective initiative to bring on your first customer. Though the go-to platform for search engine marketing (SEM) is Google, it may be good to consider other platforms. Yahoo still has a decent market share with a specific audience. With older generations still using Yahoo, the platform may provide further reach. Younger audiences use Instagram and TikTok for search. Though Google is quite ubiquitous across age groups, other search engines have uniqueness in their user base and reach. To effectively get results with SEM, it’s important to first match your audience with the platform. Some of these platforms live in the intersection of search and social media. To have an effective SEM strategy, it’s important to have a good understanding of the social media market in Japan.

Conclusion

The search engine market in Japan has some unique nuances. Though Google has now become the dominant player, Yahoo has been a key player in the local market. Yahoo entered the Japanese market before Google, so the initial internet users started and have stuck with Yahoo. Social media platforms are doubling as search platforms, especially among younger generations. The lines between traditional search engines and social media platforms are blurring due to changes in how people consume content. The key to a strong marketing strategy in Japan is to understand the nuances of these platforms. If you are looking for a custom marketing strategy, book a consultation here.

The users that adopted Yahoo in the 1990s and 2000s have continued to use Yahoo, while younger generations used other search engines (primarily Google after it entered the Japanese market). The users that started out with Yahoo have stuck with Yahoo. They were in their teens, 20s, and 30s in the late 1990s and early 2000s and now are over 40. So where have other generations turned to for search if not Yahoo?

The users that adopted Yahoo in the 1990s and 2000s have continued to use Yahoo, while younger generations used other search engines (primarily Google after it entered the Japanese market). The users that started out with Yahoo have stuck with Yahoo. They were in their teens, 20s, and 30s in the late 1990s and early 2000s and now are over 40. So where have other generations turned to for search if not Yahoo? -2024-06-29-at-12.06.58-PM.jpg) In a survey that asked the respondents for their top three commonly used search engines, Google held a similar market share across all ages. On the other hand, Yahoo usage is higher as the age group ascends. For 50 to 59 year-olds, Google and Yahoo are used equally (41% vs. 40%) while teenage usage of Google is about triple Yahoo’s (38% vs. 13%).

In a survey that asked the respondents for their top three commonly used search engines, Google held a similar market share across all ages. On the other hand, Yahoo usage is higher as the age group ascends. For 50 to 59 year-olds, Google and Yahoo are used equally (41% vs. 40%) while teenage usage of Google is about triple Yahoo’s (38% vs. 13%).