B2B SaaS Sales in Japan

Introduction

B2B SaaS sales in Japan is likely a black box for many companies considering entering Japan. This may be one aspect that causes companies to have trepidation in entering the Japanese market. The Japanese sales landscape is quite different from other markets. The SaaS sales landscape has evolved in the US with product-led growth gaining traction over the past 10+ years. Product-led growth (PLG) is still a rather new concept in Japan with a high reliance on sales-led growth (SLG). Indirect sales (working with partners, resellers, and distributors) is also a big portion of revenues for many SaaS companies and adds another dimension to selling in Japan: B2B SaaS sales in Japan is not only PLG vs. SLG, but also direct vs. indirect sales. B2B SaaS sales is not one size fits all in Japan and the growth strategy evolves over time.

PLG vs. SLG

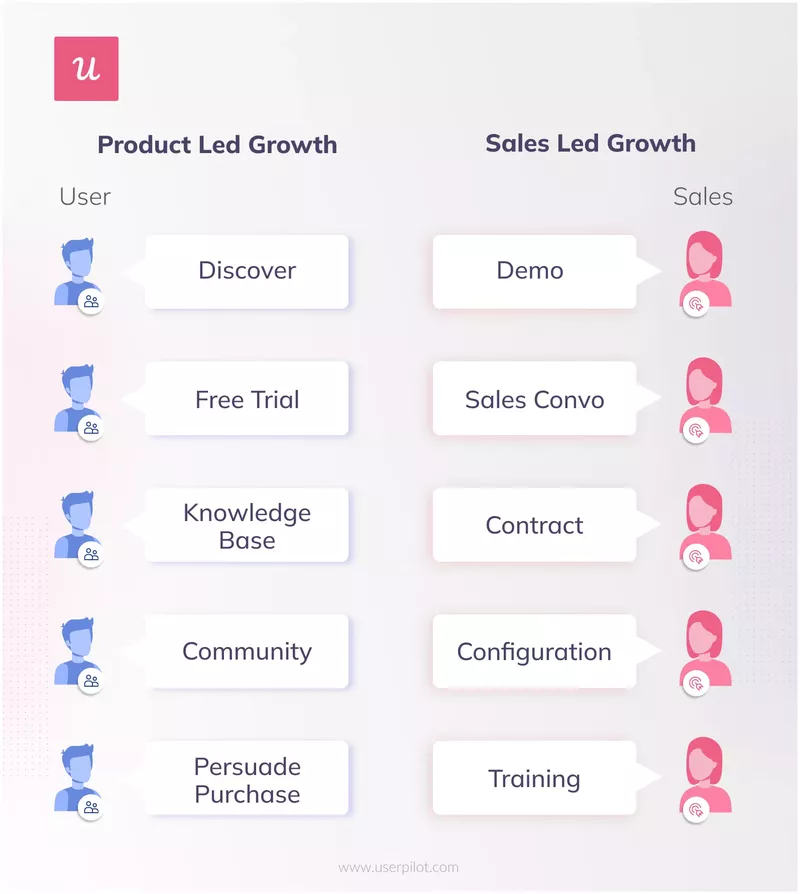

Product-led growth has become a common strategy that many SaaS companies are implementing. Pure product-led growth is hard to achieve but companies that have achieved it have reaped amazing rewards. PLG relies on an intuitive product that end-users can use and onboard without any support from a specialist. The first action in engaging the product is to actually use the product.

Image source: UserPilot’s “Product-Led vs Sales-Led: What’s the Difference, and Which One Is Right for You?”

On the other hand, sales-led growth is driven by salespeople explaining the benefits of using the product. Usually, the end-user has to be in communication with a salesperson before using the product. There may be different reasons to implement a sales-led funnel, but a common reason is the complexity of the product. If the only way to get the full value of the product is to go through complex implementation, a sales-led motion makes perfect sense. It’s pretty common to see less complex tools implement a PLG strategy, while more complex solutions have a SLG strategy. There are trade-offs of having PLG vs. SLG, but the strategy usually evolves after layers of iterations.

Companies that initially relied on PLG will naturally shift into a hybrid model when implementing a indirect sales strategy. The sales-driven approach has two layers. The first layer is bringing on the partners, resellers, and distributors. There’s a high component of sales when convincing partners, resellers, and distributors to take on a product. The second layer is selling to the leads that come from the indirect sales channel. Once service providers start accessing companies from the channel partners, sales become more relevant, as these companies usually require convincing before trying out and purchasing a new product. When a service provider engages channel partners, the process naturally shifts to incorporate a more formal sales process. This does assume that the service provider has created a win-win relationship with the reseller, distributor, and partners are symbiotic.

PLG vs. SLG + Direct vs. Indirect Sales

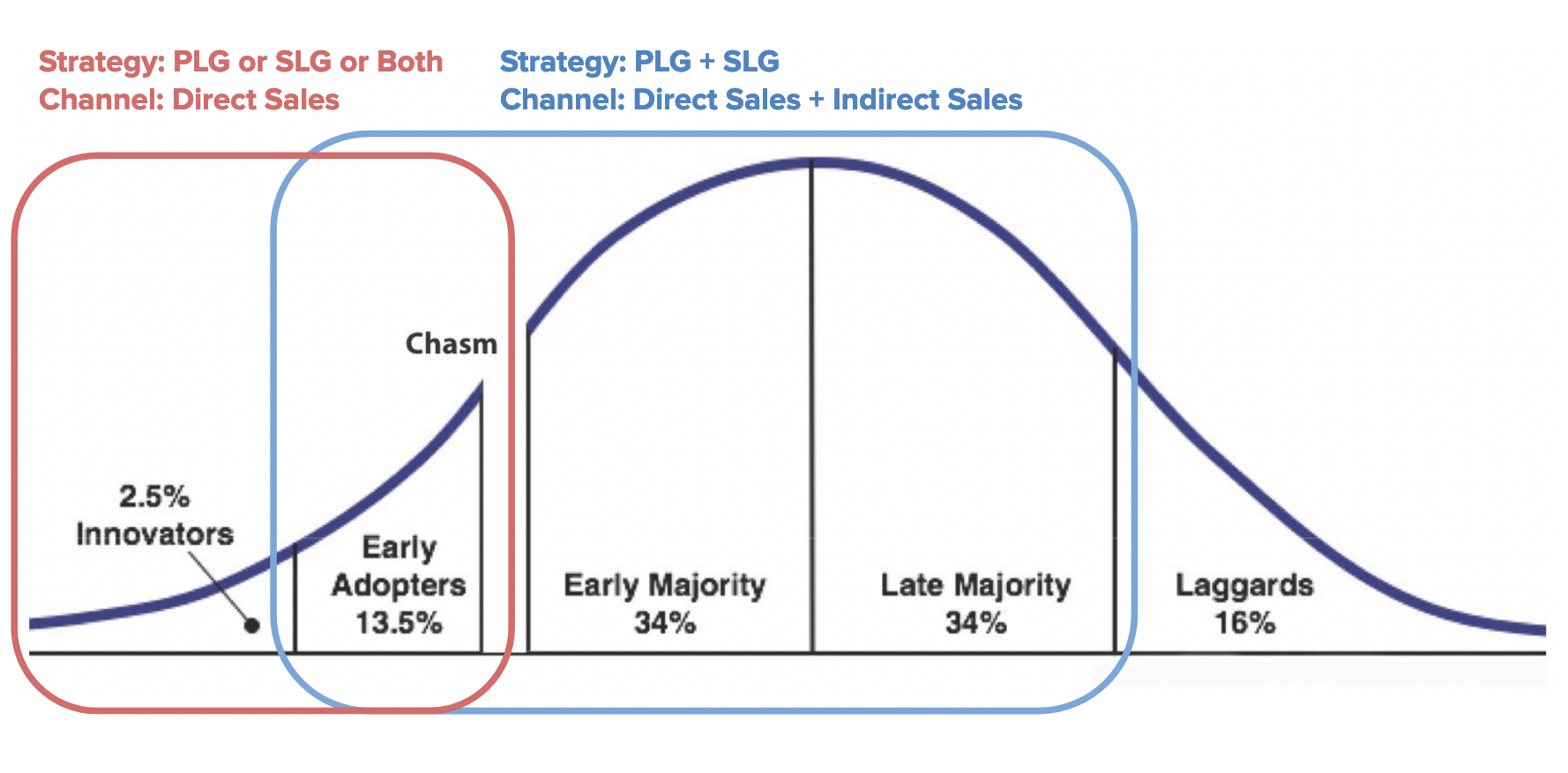

The growth strategy changes and evolves depending on the phase of the company. Different phases require a different strategy and process.

Selling to innovators, those who are willing to test out new products on their own accord, can be driven by the product. Many companies will start with PLG supported by founder-led sales. Some companies have a very clear idea of their target customer and start with strictly a sales-driven approach. Many companies will start by providing access to the product through a free trial or allowing leads to download a deck.

Selling to innovators, those who are willing to test out new products on their own accord, can be driven by the product. Many companies will start with PLG supported by founder-led sales. Some companies have a very clear idea of their target customer and start with strictly a sales-driven approach. Many companies will start by providing access to the product through a free trial or allowing leads to download a deck.

After creating a foundational base of customers and showing indications of PMF, companies will move to selling to early adopters. The direct sales strategies tend to be similar or the same as selling to innovators, but this is the phase where many companies consider implementing a partner sales channel or working with resellers and distributors. Partners, resellers, and distributors are a great channel to help companies cross the “chasm” and validate further product-market fit by selling into a larger group, the early majority. Selling to partners, resellers, and distributors requires a different, and at times a more formal, sales process. As a result, the growth strategy inevitably involves more sales.

Selling to the early majority, whether directly or indirectly, usually requires a sales-driven approach. Unlike innovators, who need no additional motivation to engage the product, the initial goal is to have the end user use or test the product.

The growth strategy in Japan is not a PLG vs. SLG discussion, as Direct vs. Indirect sales adds another dimension. The decision should be around meeting the end-user’s purchasing patterns, which change drastically depending on the persona. The strategy ultimately evolves with the phase of the company to meet the change in buyer persona.

Conclusion

Conclusion

Selling in Japan has layers and the growth strategy is likely to evolve. A company that started with PLG may end up with some SLG in the mix. Some companies might omit PLG entirely. Like any region, the strategy should be based on the patterns of the customer persona. That being said, Japan’s unique reliance on partners, resellers, and distributors acts as a trigger for companies to implement a sales-driven motion. The channel partners and their list of contacts will likely require a more formal sales process rather than the product selling itself. If you’d like to learn more about selling in Japan or are considering entering the Japanese market, book a consultation here!

Source: OpenView’s “

Source: OpenView’s “