The State of Venture Capital in Japan

The Venture Capital environment is growing at a rapid rate in Japan, but the VC investments are still a small fraction compared to developed ecosystems.

Venture Capital in Japan

Taking a look at the numbers, there were 3,062 investments at a total value of 945.9 JPY (7.28b USD assuming an exchange rate of 130 JPY per USD), while in the US there were 16,464 for a total value $235B USD investments. The median VC investment in the US was about $7M USD (down from $14M USD in 2021) dwarfing the median investment in Japan at 100K JPY ($769K USD).

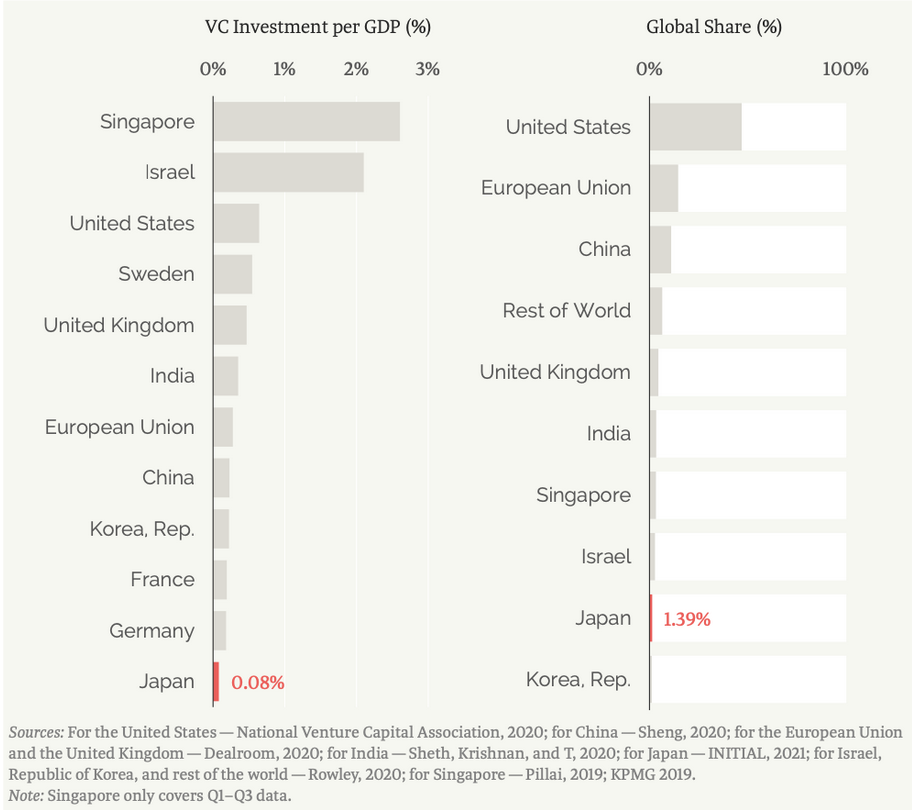

Looking at the comparative VC investment from a different angle, VC investment per GDP in Japan comes in at 0.08%, lagging behind countries like the US, Singapore, Israel, and European countries. Even though Japan has the third largest economy in the world, Japan’s global share of Venture Capital investment is 1.39%.

Table: Venture Capital Intensity by GDP (Left) and Global Share of Venture Capital Investment, 2019 (Right)

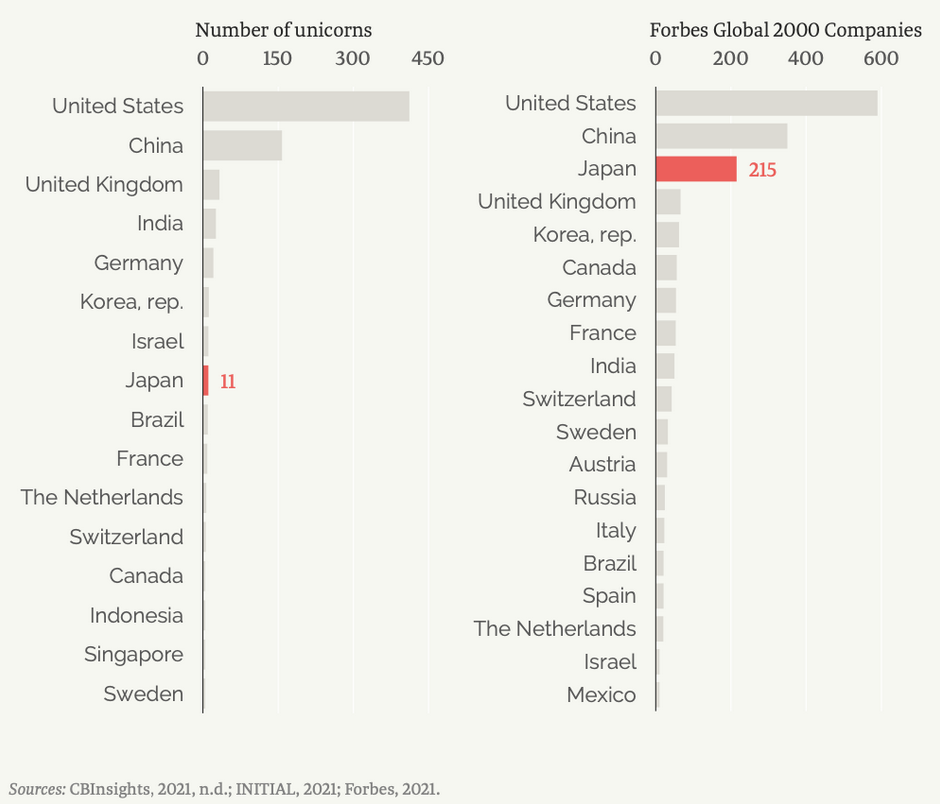

At the time of the research conducted by the World Bank, Japan had 215 of the Forbes Global 2000 companies, but only had 11 unicorns.

Table: Number of Unicorns per Country, 2021 (Left) and Number of Forbes Global 2000 Companies per Country, 2021 (Right)

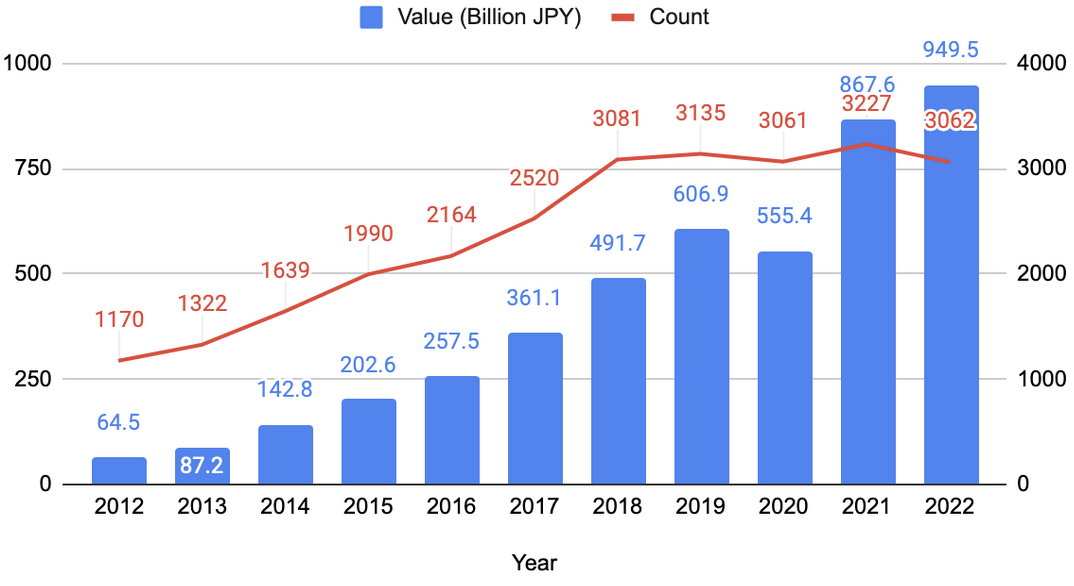

That being said, Japan is in the very early days of Venture Capital. Dating back to 2012, there were 1,170 VC investments in Japan. This number has increased by close to three times, ending 2022 with 3062 investments. The total value of investments tells a more compelling story of the VC investment growth: In 2012, the total invested value was 64.5b JPY. By 2022, this number has grown by almost 15 times to 949.5b JPY. Though the magnitude of the market is different, it is also worth noting the resilience of the Japanese VC market. In the US, VC investments shrank from $360B USD to $235B USD, a 35% drop, from 2021 to 2022. Unlike the US market, the total investments by the Japanese VC market grew by 9.4%

Table: Count and Value of VC Investments in Japan

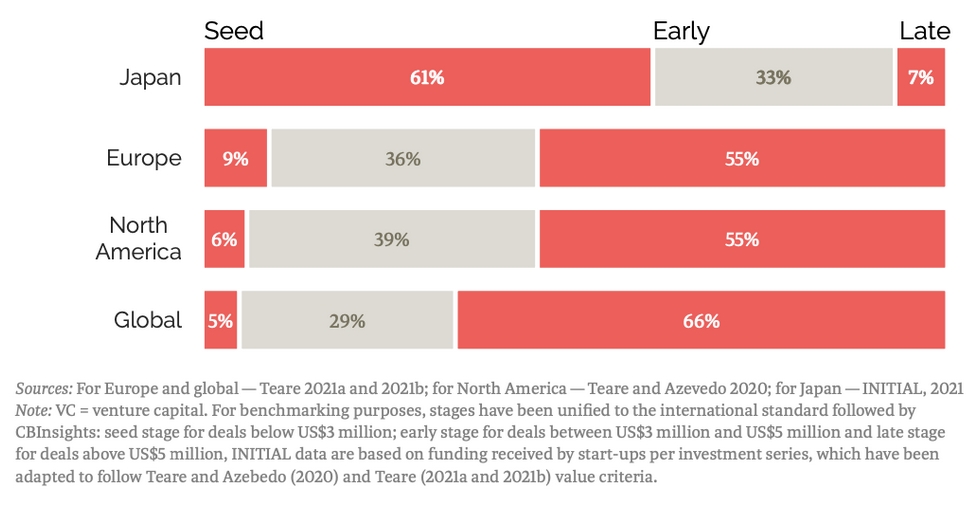

The distribution of the investment also indicates that Japan is still in the early days of VC investments. Japanese VC investments are heavily weighted toward seed-stage companies. These seed investments will later be viable targets for early and late-stage investments. Some reasons hinder late-stage investments in Japan, which we’ll jump into the next section, but the heavy weighting should over time redistribute itself to more early and late-stage investments. The distribution also explains the difference in investment size between the US and Japan. The median investment in the US is $7M USD. It makes sense that this number is much larger than Japan’s 100M JPY ($769K USD) per investment. Given that the majority of the US investment is in late-stage companies, the investment size is naturally larger.

Table: Distribution of VC Investment Stages

Limited Late Stage Investments

An interesting trend is that there is significantly more investment in seed companies than in other markets. One possible explanation is that there aren’t as many late-stage companies available to investors. There are two likely factors that are driving this phenomenon.

The first driver is purely a lack of companies to invest in. There were 1428 investments across all sectors in 2014 in Japan. CB Insights took a look at tech companies from 2008-2010 that raised money. 48% were able to raise a second round of funding. Only 15% were able to raise the equivalent of a series C. If we take 15% of 1428 companies invested in 2014, there would only be roughly 200 companies that would be eligible for a series C. If we narrow the scope to just SaaS, there were 130 VC investments (learn more about the SaaS in Japan here). Using the same 15% assumption, there would only be about 20 companies that would have been able to raise a series C. The overall pool of companies to invest in is significantly smaller in Japan compared to more robust ecosystems.

The second drive is the relative ease of IPO in the Japanese market. Looking purely at revenues, the companies that are going public are companies that would be prime candidates for raising a series C or series D. In the table below, you can see that Japan had 42 IPOs in 2019. During the same period, the US had slightly under double the IPOs coming in at 82. The United States has 20x the investments, but only 2x the IPOs. This is a reflection of the lenient requirements to list in Japan. This is also the most likely explanation for the limited number of unicorns in Japan.

Table: Start-up IPOs 2019, United States versus Japan

Another possible factor is the barrier to going public in Japan. Japanese companies can go public with much smaller revenue. Looking at IPOs in the mothers market in 2021, there were 93 IPOs on the Mothers market.

Table: Breakdown by Revenue of IPOs on the Mother market in Japan in 2021

| Count | Proportion of all IPOs | |

| Under 1b JPY (Under 9m USD) | 17 | 18.5% |

| 1b JPY to 2b JPY (9m USD to 18m USD) | 26 | 28.3% |

| 2b JPY to 4b JPY (18m USD to 36m USD) | 24 | 26.1% |

| 4b JPY to 6b JPY (36m USD to 55m USD) | 13 | 14.1% |

| 6b JPY to 8b JPY (55m USD to 73m USD) | 5 | 5.4% |

| 8b JPY to 10b JPY (73m USD to 91m USD) | 1 | 1.1% |

| 10b JPY+ (Over 91m USD) | 6 | 6.5% |

Of the 93, 17 went public with revenues under 1b JPY, which is around $9M USD (assuming a 110 JPY per 1 USD exchange rate). 73% of the IPOs on the Mothers market had revenues under $36M USD. About 54% of the IPOs had revenues between 1b JPY and 4b JPY ($9M USD to $36M USD). This range would usually be considered prime targets for late-stage investments.

Compared to the Japanese companies, US companies stay private with much greater revenues. Looking at SaaS companies that went public in 2018 and 2019, the average annual recurring revenue (ARR) is about $300M USD with the median being $228m. Given that Japanese companies can go public with a fraction of the revenue of companies in the US, they end up going public instead of raising a series C or D.

This is also likely the main explanation for the lack of unicorns in Japan. As of 2023, there are 20 unicorns from Japan, compared to 641 in the US. There is no real need and urgency for Japanese companies to aim for unicorn status since they can go public.

There are pros and cons of going public. Some companies in Japan are now choosing to stay public to focus on growth. A prime example of this is SmartHR. SmartHR is valued at $1.51B USD and raised a series D in 2021. They definitely have the financials to go public, but it seems like there’s a conscious decision to stay private. That being said, the decision to stay private must have been a joint decision between the investors and the management team, so there has to be alignment between the two parties.

Conclusion

The venture capital environment in Japan is nowhere near the size of the US, but it is definitely up and coming, and many things can add to this momentum (You can read specifically about SaaS in Japan here). It might be the government’s effort through the Startup Development Five-Year Plan to build a robust ecosystem or increased awareness of the Japanese market to foreign investors. Regardless, the Japanese venture capital environment is only at its beginning. As the number of startups increases, there will be more companies to invest in — With the heavy inclination to seed investments to date, these companies should soon be prime targets for additional funding. There are potential obstacles to later stage investments, including the relative ease of IPO in Japan, but there are trends that address these issues. The Japanese startup ecosystem is in a great position for growth and should lead to further innovation.

Sources:

“Venture Capital Funnel Shows Odds Of Becoming A Unicorn Are About 1%”, CBInsights