The State of the Startup Ecosystem in Japan

Startup Ecosystem in Japan

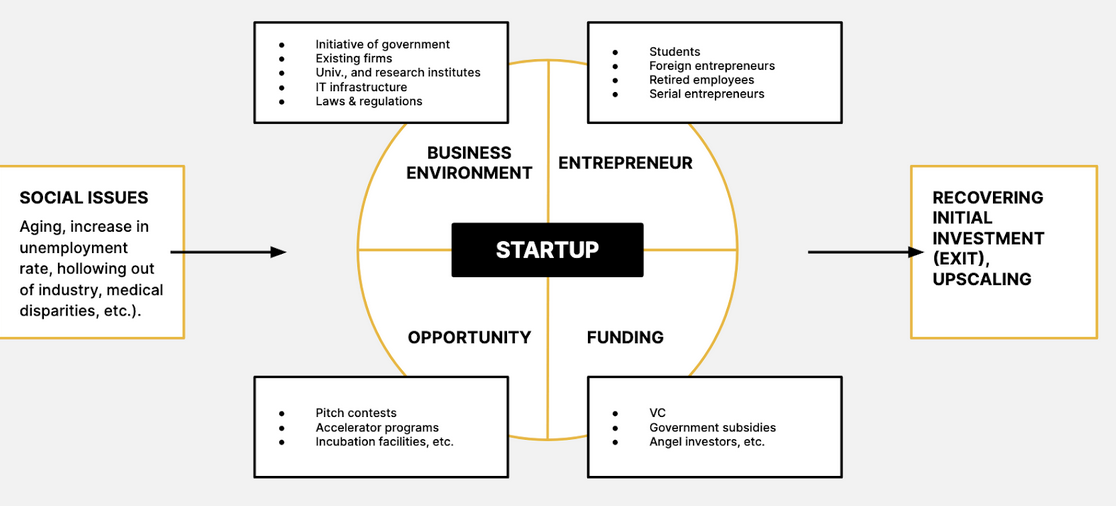

A startup ecosystem is said to have general factors, the business environments, entrepreneurs, opportunity, and funding. The business environment is the local infrastructure including laws, regulations, government initiatives, etc. The business environment essentially should provide ease in building a startup. Entrepreneur is the availability of the people who are looking to start a startup. Funding is the availability of capital to invest in the entrepreneurs and startups. Opportunity is the availability to facilitate the startup’s growth through pitch contents, accelerator programs, incubation facilities, etc.

Source: Has the Startup Ecosystem in Japan Formed?

Compared to Silicon Valley, the most robust startup ecosystem, JETRO (Japan External Trade Organization) says that Japan only has one of the four factors, the business environment. The Japanese government is actively working on the business environment with friendlier policies for startups. For example, the J-Startup program was launched in 2018 by METI (the Ministry of Economy, Trade and Industry) aims to work with Japanese startups to empower them to be able to compete globally. Also, in the 2022 Basic Policy for Fiscal Management and Reform announced by the Japanese government, startups were one of five priority areas for investment. As startups are a priority, the government released a Startup Development Five-Year Plan (you can check the progress of the Startup Development Five-year plan here). The business infrastructure is actively being worked on and will hopefully facilitate more startups.

As for funding, more and more Corporate Venture capital (CVC) is entering the market. Corporations are looking to partner with startups to further develop existing research and development. Entrepreneurs will likely continue to be a problem for Japan.

Opportunity for Global SaaS Companies

The Japanese ecosystem is getting more robust with proper government support and initiatives. That being said, the overall ecosystem is playing catch up and that includes the SaaS market. In 2019, there were 3407 investments in SaaS companies in the US compared to 156 in Japan. There is still a limited number of SaaS solutions in the market and plenty of room for global companies to be a real solution in Japan with the proper localization efforts. There are a few options on Japan entry — If you’d like to learn more about Nihonium’s, book a consultation here.

Source:

Source: