The State of SaaS in Japan 2023-2024

Introduction

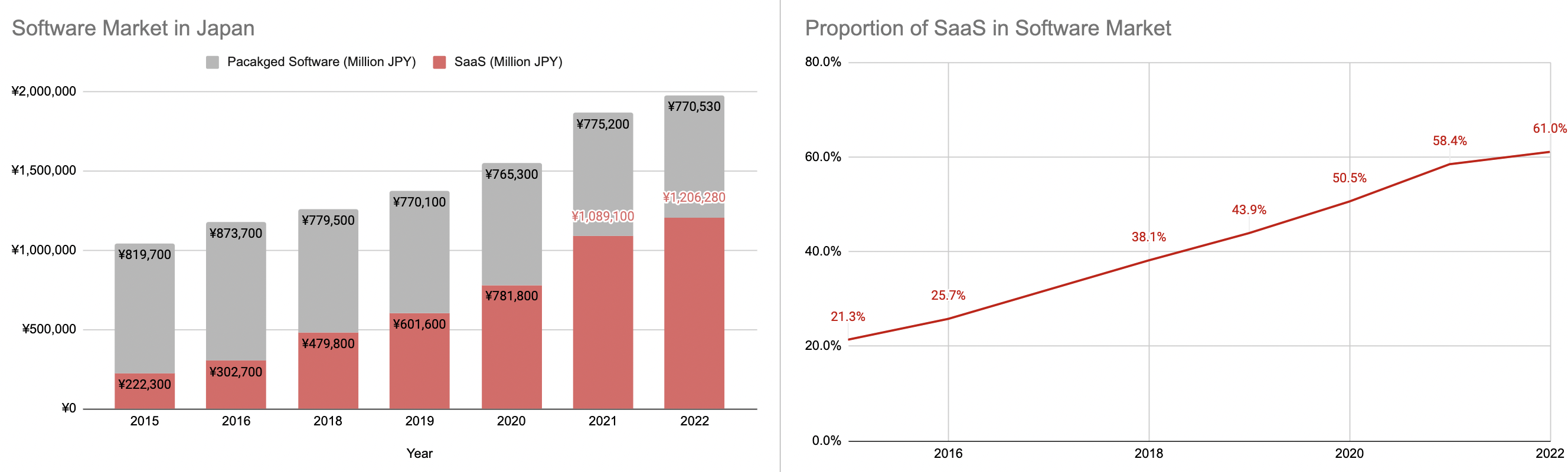

SaaS in Japan is in the midst of high growth with more companies. From the end of 2015 to 2022, the SaaS market experienced over a 30% CAGR and is expected to continue its growth. Software in Japan is still catching up to other markets. Still, being the second largest enterprise software market worldwide, SaaS will continue to be an interesting and important market for global companies and investors. For the 2024 funding funding trends, you can visit this post.

Startup Investments

Starting with overall startup investments, 2,828 companies received investments in 2023. The overall investment amount was 753.6b JPY. This was down from 2022 when 3675 companies received a combined 966.4b JPY. Similar to the global markets, startup investments dropped with fears of a possible recession.

Source: Initial’s “Startup Finance 2023”

Though the number of investments and the gross value decreased, the average investment stayed flat. This is a reflection of larger early-stage rounds trend and more later stage companies later-stage round becoming more available as they don’t go public as quickly.

Source: Initial’s “Startup Finance 2023”

Conclusion

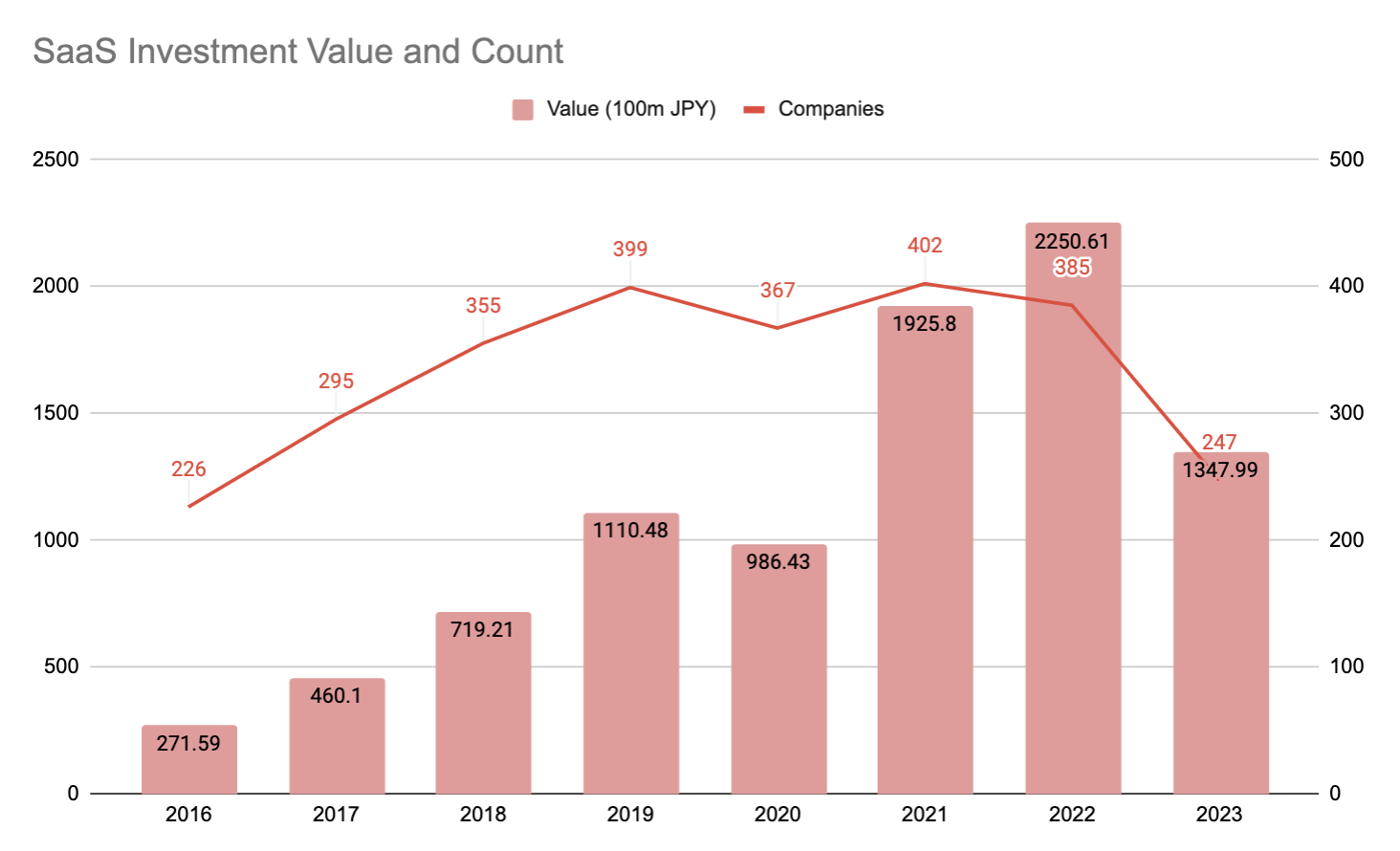

SaaS investments saw a dip in 2023 compared to 2024. SaaS investments may bounce back to higher numbers than in 2022. With the Nikkei reaching record highs, global investors are looking to access Japan. With an influx of foreign investors and a strong base of domestic investors, the desire to invest in Japan exists.

The level of SaaS adoption in Japan is still low, so SaaS will likely continue to be a highly relevant topic moving forward. With Japan being the second largest enterprise SaaS market worldwide, the number of SaaS offerings is growing with new local companies being started and global companies entering Japan. There is plenty of space for SaaS companies, as many categories have limited offerings or the category has yet to be created in Japan. If you are considering the Japanese market, learn more by booking a call here.