Japanese SaaS Companies vs. Global Comps

Introduction

SmartHR, one of Japan’s unicorns, recently hit the 15b JPY ($100m assuming 150 yen to dollar exchange rate) mark, a huge milestone for any SaaS business. This got me thinking about SmartHR’s US comps and when they crossed the 100m USD mark.

SmartHR offers cloud-based labor/human resource management founded in 2013. Workday, founded in 2005, is also in the HR space and is a “provider of enterprise cloud-based applications for human capital management (HCM), payroll, financial management, time tracking, procurement and employee expense management.” These two companies are not a perfect one-to-one match but have enough overlap for some interesting analysis.

This prompted me to look into other sectors including e-signature and cloud-based accounting.

SmartHR vs. Workday

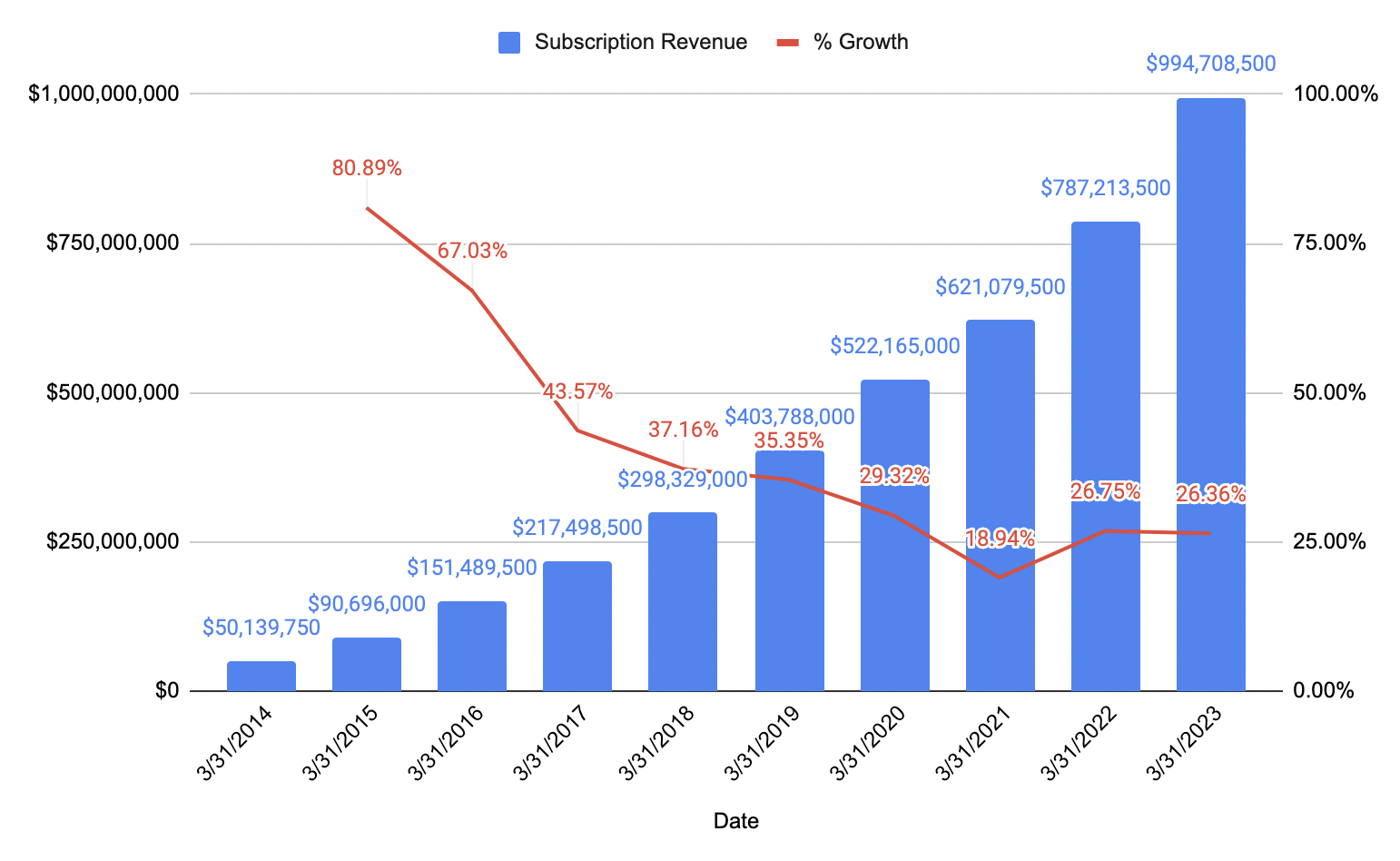

SmartHR crossed the 15b JPY ($100m) mark in 2024, 11 years after being founded. This number is purely subscription revenue. It looks like Workday’s subscription revenue crossed the 100m USD mark in 2013 after about 8 years of starting:

SmartHR’s Revenue as of February 2024 and Workday’s Historic Subscription Revenues

Workday continued to grow after crossing the 100m USD mark. The year it crossed 100m USD, it grew 114.73%, finishing the fiscal year at 190.3m USD. The following year, the growth continued at 86% and finished the 2014 fiscal year at 354.2m. If the success of its US comp is any indicator of success, SmartHR is in great shape for continued growth.

CloudSign vs. DocuSign

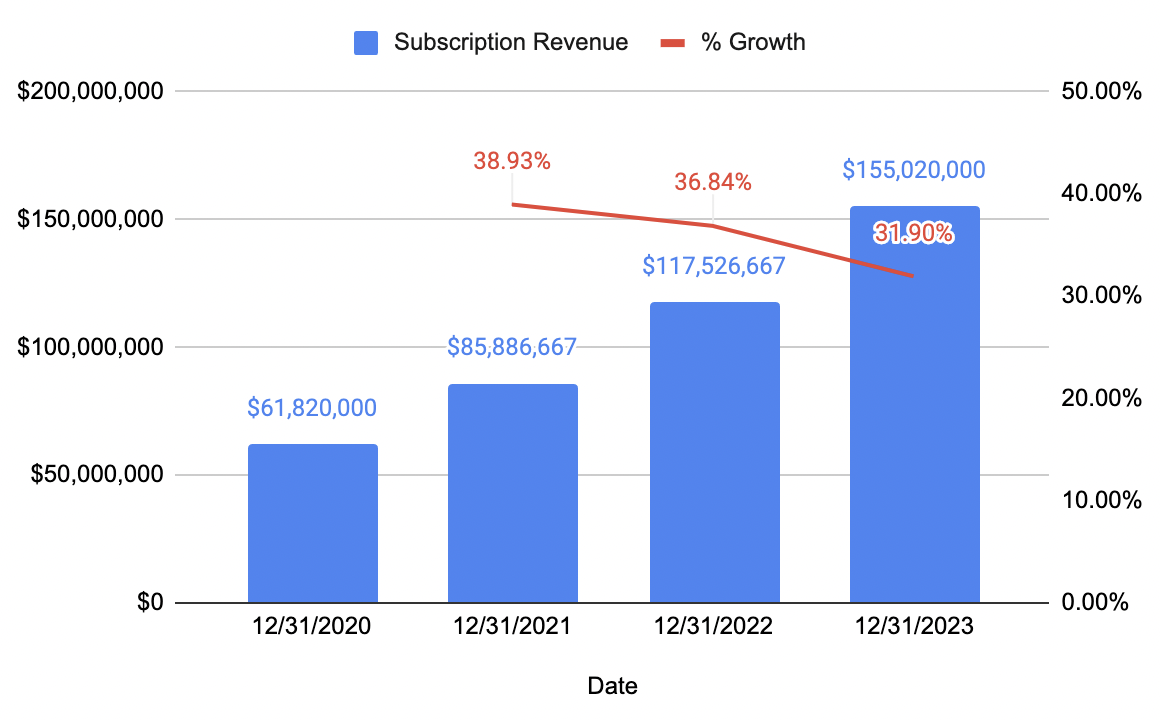

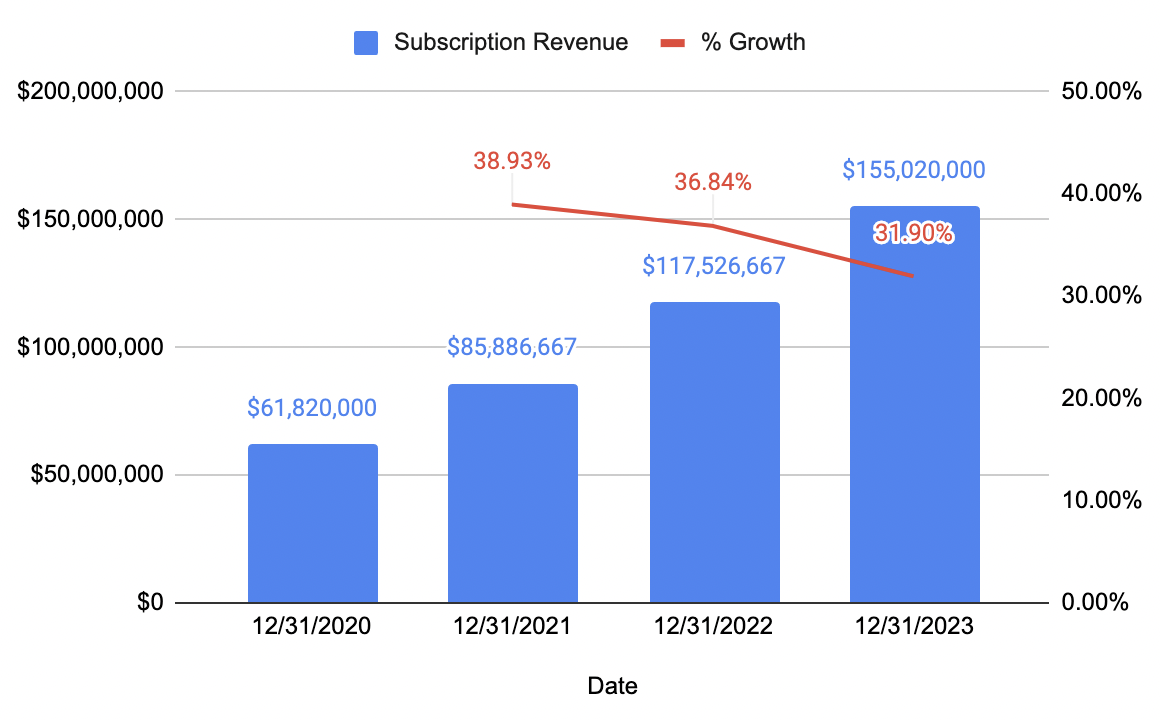

CloudSign is Japan’s leader by market share (21.4%) in the e-signature space. Bengo4.com, a platform that connects users to layers started offering CloudSign as a separate product line in 2015. As of FY2024Q3, CloudSign is Bengo4.com’s largest business segment in terms of revenue, representing 55.6% of subscription revenue and 46% of all revenues.

CloudSign’s Subscription Revenue

CloudSign hasn’t cleared the 100m USD mark, its subscription revenue as of the end of 2023 sits at $37.1m significantly surpassing FY2023’s revenue figures. With a quarter remaining in its fiscal year, it’ll be interesting to see how much more revenue it’ll be able to add.

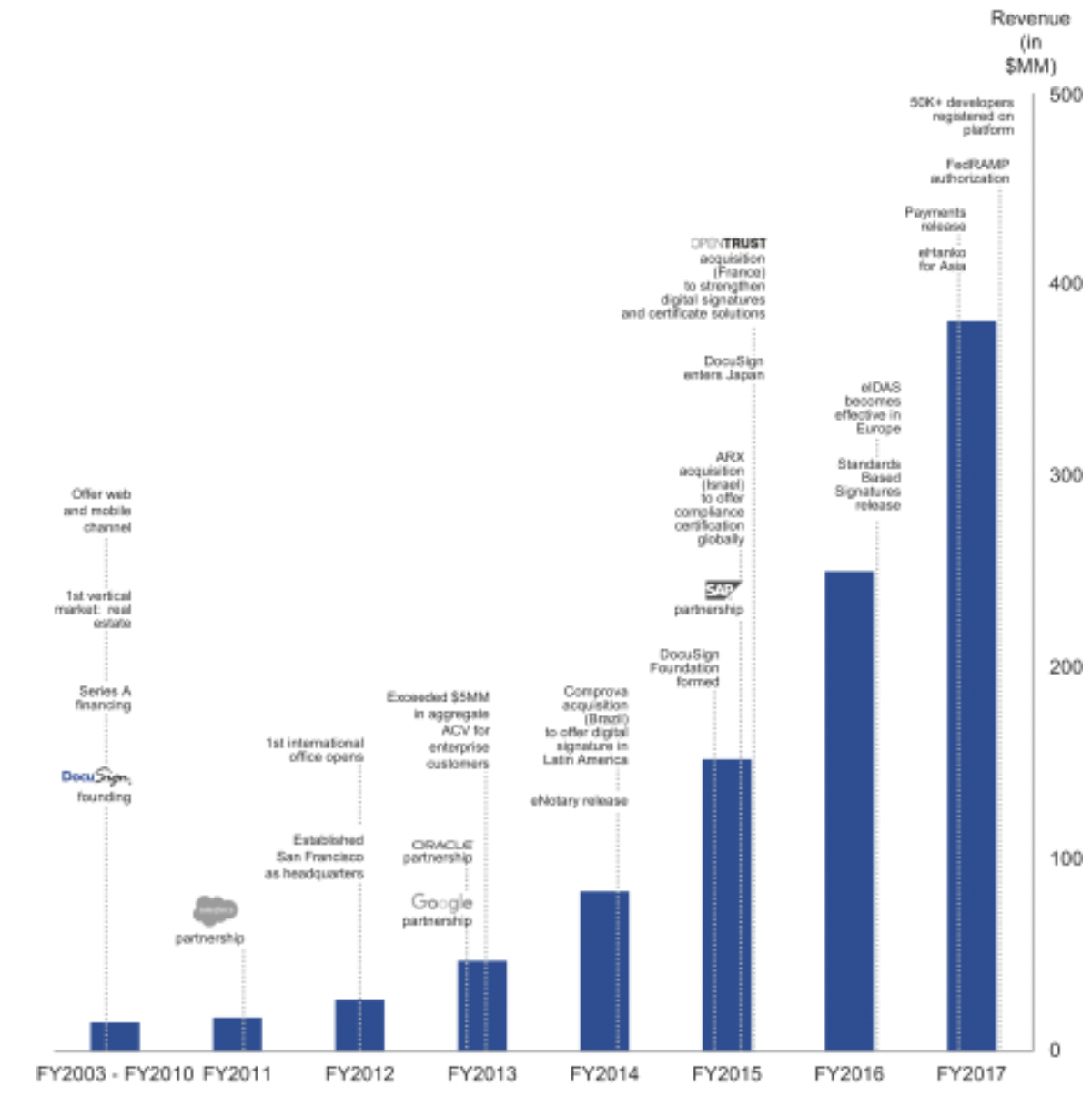

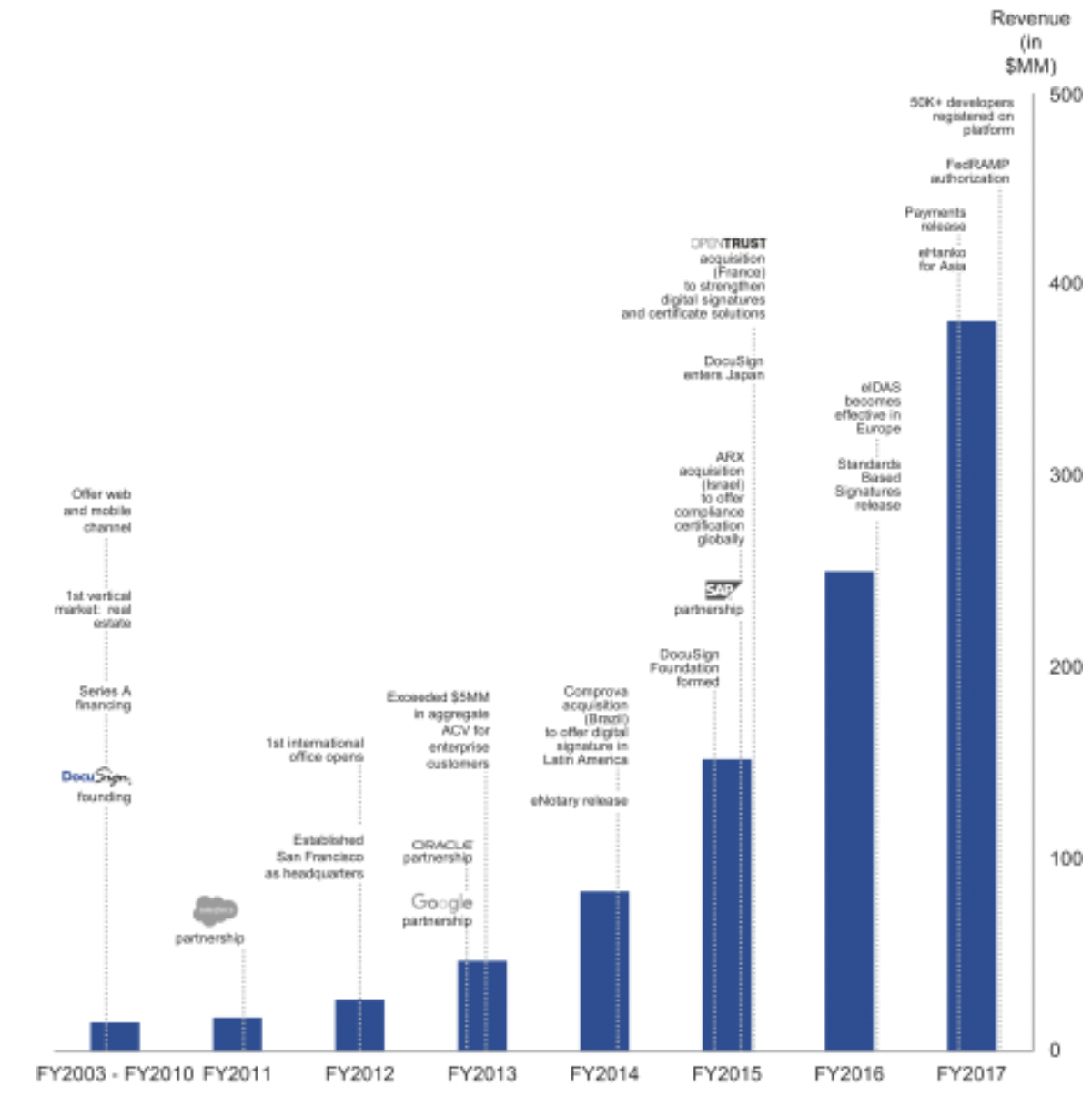

While e-signatures are a relatively new phenomenon in Japan, they have been around since the early 2000s in the US with DocuSign which was founded in 2003. DocuSign went public in April 2018 with $348.6m in subscription revenue in January 2017. Though there was no precise data on DocuSign’s earlier revenue, the following chart included in DocuSign’s S-1 indicates that DocuSign crossed the $100m mark 11 to 12 years in.

DocuSign’s Revenue Growth

DocuSign has continued to grow to have revenues over $2b. Based on DocuSign’s chart and CloudSign’s numbers, CloudSign looks to be in a similar place as DocuSign was in FY2012/FY2013. The Electronic Books Preservation Act, which requires companies to store certain documents to be stored electronically, is likely to provide CloudSign additional momentum, as only 28.5% are fully ready/compatible with the new law.

Freee + MoneyForward vs. Xero

Freee and MoneyForward are Japan’s two of Japan’s leading cloud-based accounting software providers. The two companies were founded in 2012 within months of each other, Freee in July and MoneyForward in May. They both have gone public on the Tokyo Stock Exchange and have grown to over $100m in subscription revenue.

MoneyForward Subscription Revenues

MoneyForward crossed the $100m ARR mark in 2022. Freee also crossed the $100m mark in 2022:

Freee’s Subscription Renenue

MoneyForward has a higher growth rate, but the companies have followed very similar revenue trajectories since their inception.

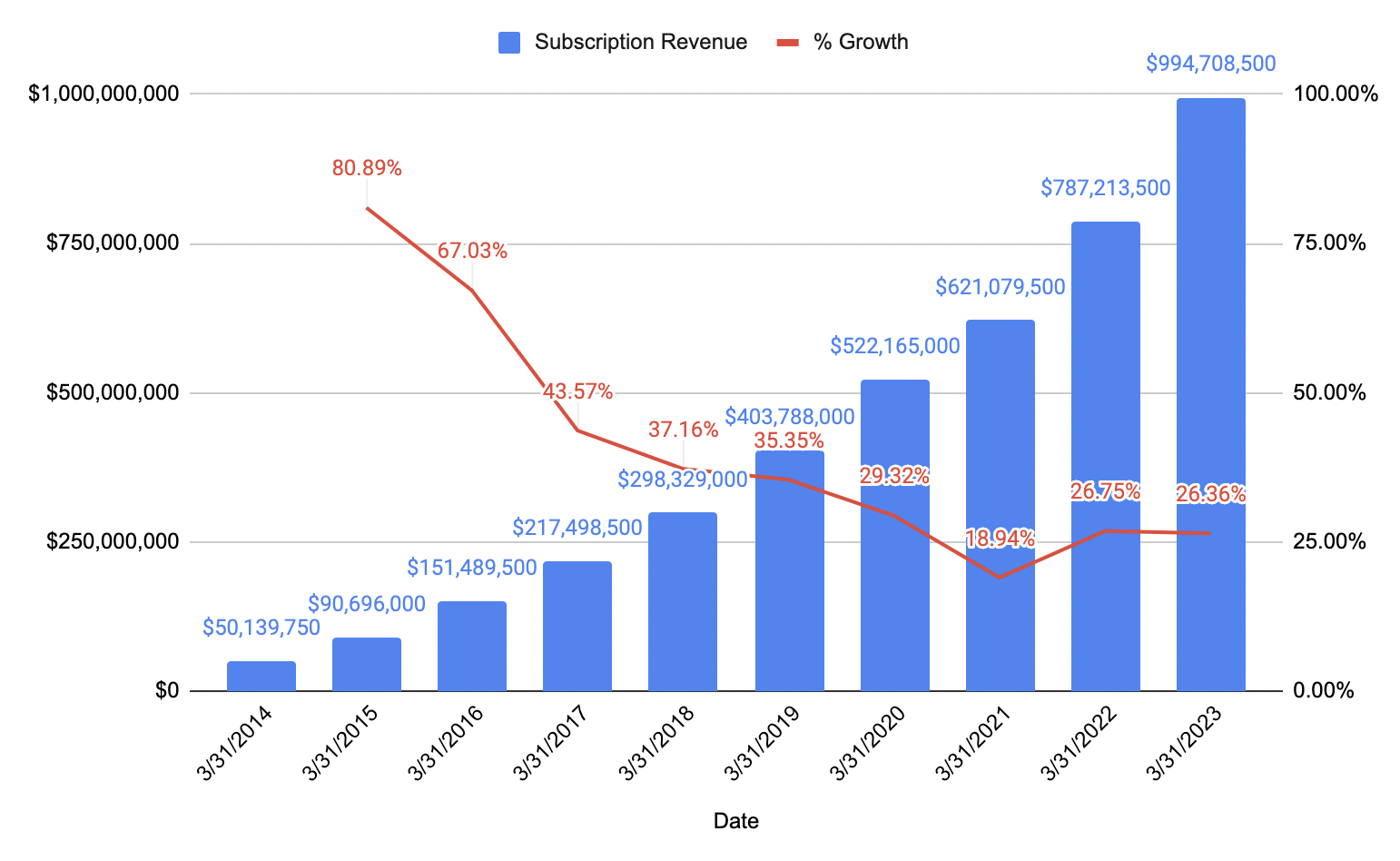

On the other hand, Xero, a New Zealand-based company, offers cloud-based accounting as well. Xero started in 2006 and crossed the $100m mark in 2015 (assuming 0.75 AUD/USD conversion).

Xero’s Subscription Revenue

Xero has continued to grow finishing FY2023 at right around one billion dollars. All three companies are growing at healthy rates and if Xero is any indicator, both MoneyForward and Freee have plenty more room to grow.

Takeaways

Though the sample size is small, there are a few takeaways from analyzing the three categories. Software in Japan lags the global markets by 6 to 10 years. The inception of some of the promising SaaS businesses in Japan started 6 to 10 years after their global comps. SaaS companies in Japan, at times, have had the opportunity to get market validation before starting by observing the traction that the global comps get. That being said, Japanese SaaS companies have had success in growing in the domestic markets and there will likely be more SaaS companies reaching this milestone.

| Company |

Country |

Founded/Service Provided |

$100m MRR |

| SmartHR |

Japan |

2013 |

2024 |

| Workday |

US |

2005 |

2012 |

| CloudSign |

Japan |

2015 |

NA |

| DocuSign |

US |

2003 |

2015 |

| Xero |

New Zealand |

2006 |

2015 |

| Freee |

Japan |

2012 |

2022 |

| MoneyForward |

Japan |

2012 |

2022 |

Conclusion

This post originally started out from my curiosity to see how SmartHR compared to other HR platforms in the space. SmartHR’s success is amazing and shows the potential the Japanese SaaS market has. The Japanese SaaS market is in a similar place as the US in the mid-2010s. If the US market is any indication, the Japanese SaaS market is at the beginning stages, and there’s a ton of potential for new SaaS businesses in Japan (including existing global solutions looking to enter the Japanese market.

I plan on continuing to build this list with Japan SaaS companies and their global comps. As the list grows, hopefully, I’ll be able to provide a better sense of where the Japan SaaS companies are relative to their global comps. If you’re interested in learning more about that Japanese SaaS environment, book a free consultation here.

Sources:

Xero’s financial statements

MoneyForward’s financial statements

Freee’s financial statements

DocuSign’s financial statements and S-1 filing

Bengo4.com’s financial statements

Workday’s financial statements and S-1 filing