Insights on the Japan SaaS Market from G2 and ITReview

G2 is a common place for buyers to go when evaluating software. It provides helpful reviews and an easy-to-interpret grid of the product’s position within its category. The Japanese equivalent of G2 is ITReview. Comparing these two review sites provides interesting insights into the state of software in Japan.

Comparing G2 and ITReview

On G2 there are 93k products listed across 1.7k categories. On ITReview, there are 8,927 products listed across 810 categories. G2 has about 13x the number of products and 2x the number of categories. On average, G2 has 54-55 product listings per category, while ITReview has about 11. Taking a look at a few specific categories/tools:

1. CRM: G2 has 678. IT Review has 97.

2. Email marketing software: G2 has 588. ITReview has 35.

3. Website builder: G2 has 453. ITReview has 26.

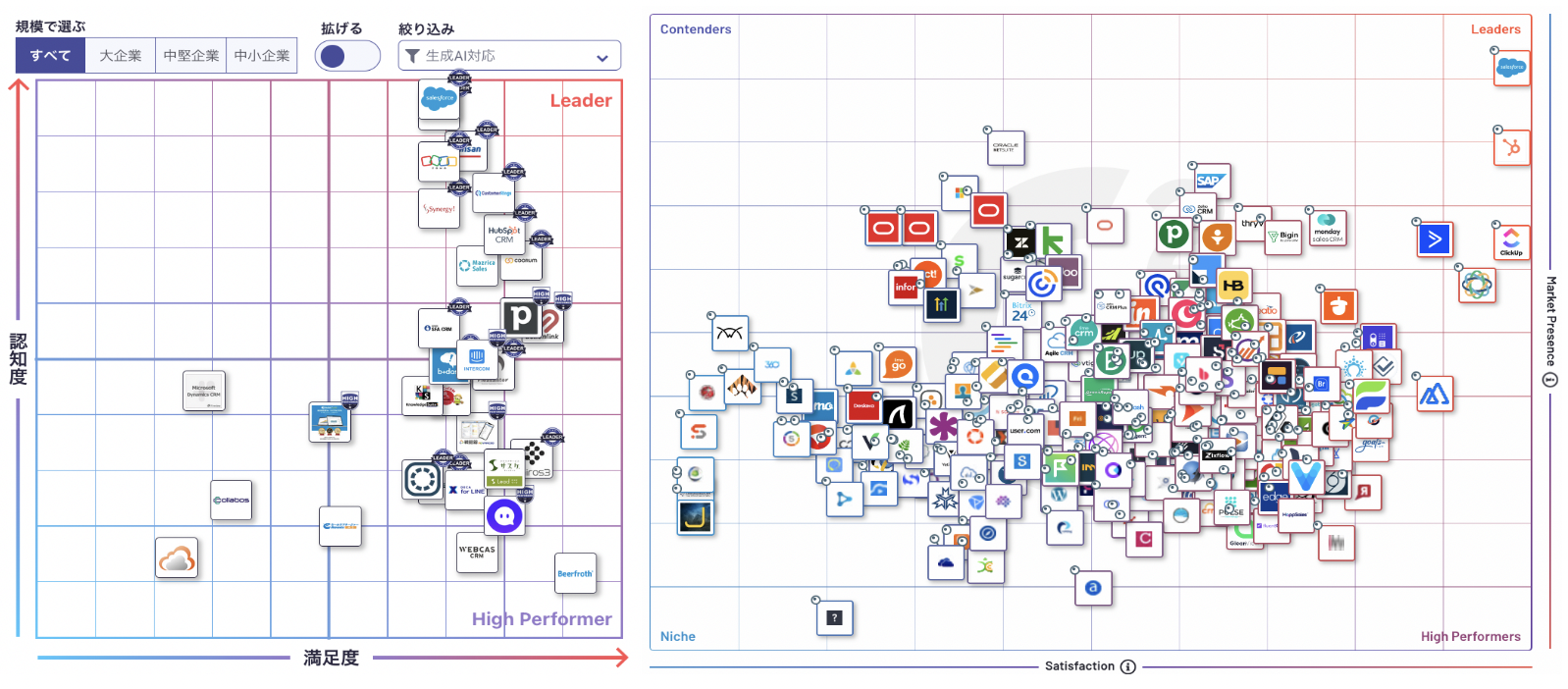

CRM Listings on G2 vs. ITReview

There’s a clear gap between the product listing between G2 and ITReview (the G2 grid has no white space!). The gap was not only prevalent in the number of products per category, but the categories themselves. G2 has more detailed categories tailored to the niches of the products. On the other hand, ITReview had bundled a few categories that G2 separated. For example, ITReview had web-based design tools as one category, while G2 broke it out into wireframing, prototyping, web design, and software design tools.

The main explanation for this gap is simple. There are not as many solutions in the Japanese market. The companies that would post on ITReview are local solutions or companies that are active in the Japanese market. The gap is simply a reflection of the relatively limited software offerings in Japan.

Key Takeaways

There are two key takeaways from comparing G2 and ITReview. The first is that there’s a massive opportunity for software companies to enter Japan. Purely looking at the G2 and ITReview comps, there’s only about one-fifth of the competition in Japan. If a company can enter Japan and create a local presence, there’s a real chance that it can be a preferred local solution.

The second is that software in Japan is only at the beginning phase. Software adoption has increased recently. As the adoption picks up, more local companies will be created to meet that demand. Global companies may also enter the Japanese market, so the competition may increase in the near future. Starting the Japan entry early and playing the long game can potentially be rewarding to companies.